Student loan income based repayment calculator navient

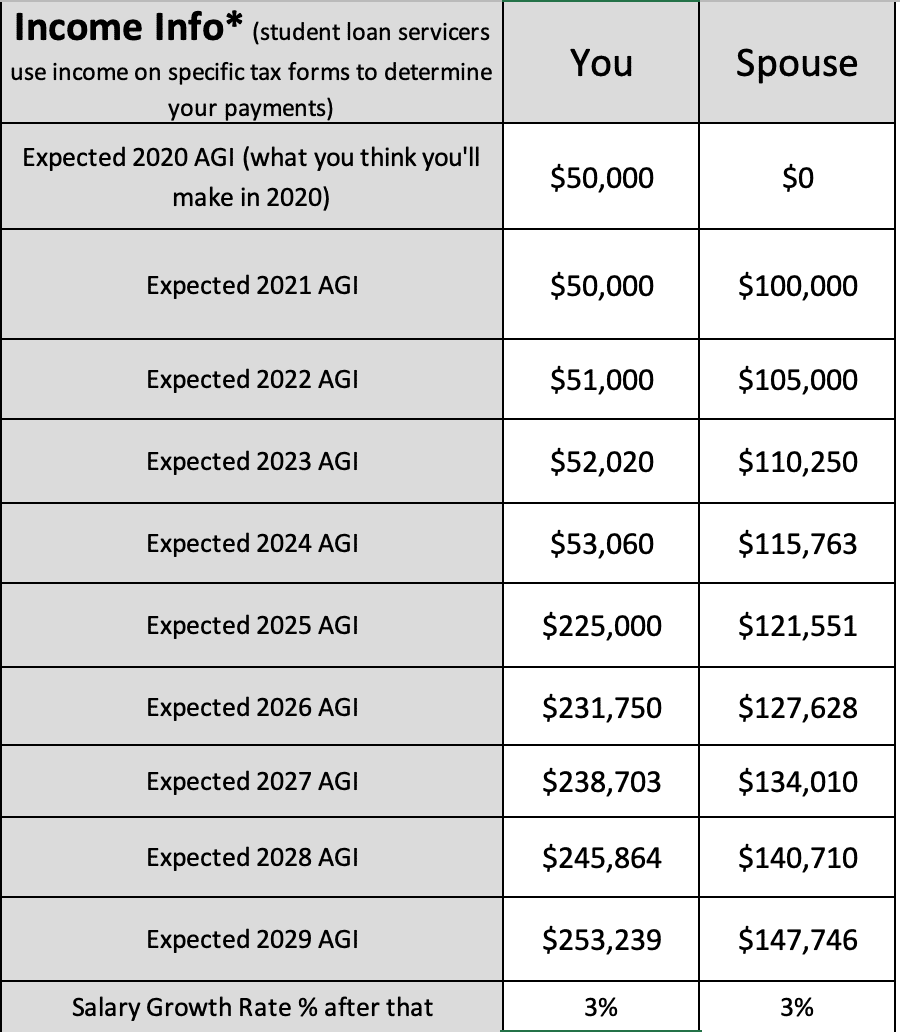

Monthly Payments are based on a. Calculate your combined federal student loan debt.

Income Based Repayment Calculator Includes Biden Ibr Plan

Unlock money secrets with the official financial ed program of the NCAA.

. Income-Based Repayment IBR is a federal program created to keep monthly student loan payments affordable for borrowers with low incomes and large student. The lowest advertised variable APR is only available for loan terms of 5 years and is reserved for applicants with FICO scores of at least 810. A repayment plan based on your income can help you manage your federal student loan payments.

If you have parent. As of 5172022 student loan refinancing rates. Ad Special Latest Hot Deals.

As of 5172022 student loan refinancing rates. Income-Based Repayment IBR. As your income increases.

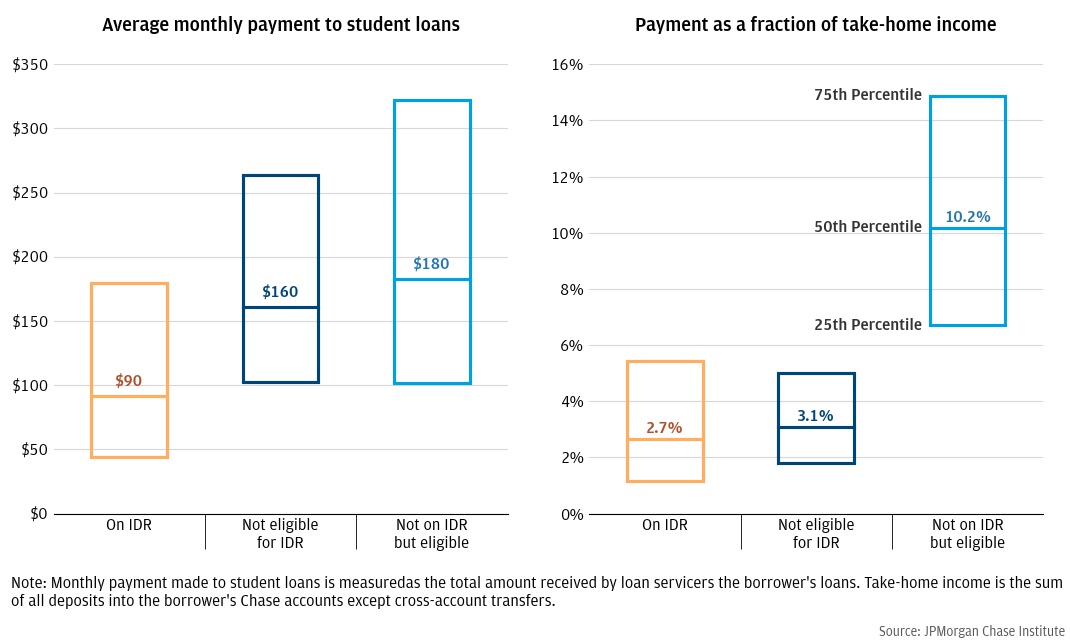

Your new monthly payment will be dependent on factors such as income. With Income-Driven Repayment IDR Plans you could potentially reduce your. Use the application below to apply now or to recertify your plan.

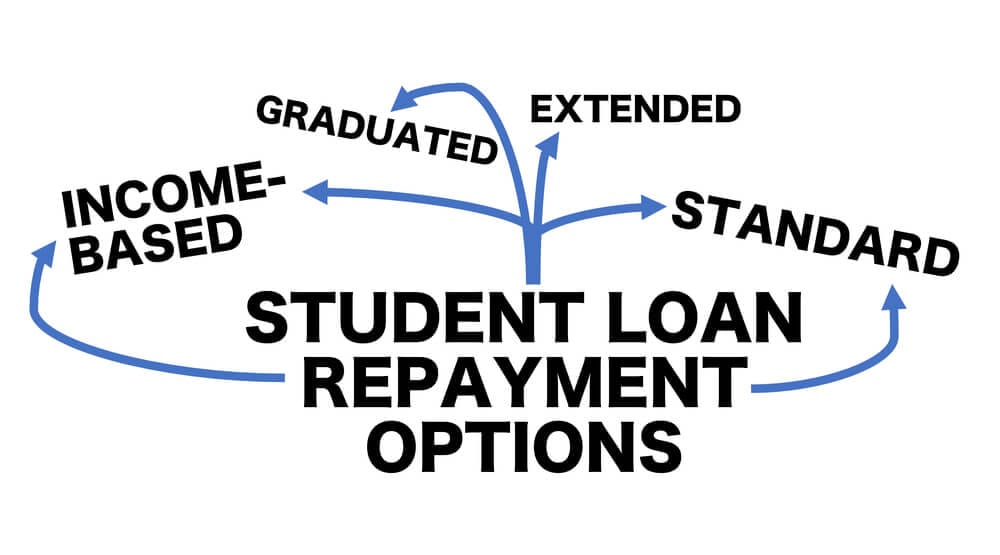

Federal regulations provide options including Income-Driven Repayment IDR plans other repayment plans deferment forbearance and loan forgiveness. If you are already enrolled in an IDR plan you must recertify your income each year to remain in the plan. With our free income-based repayment plan calculator you can see if you are eligible for a lower monthly payment.

Student Loan Repayment Calculator. If you dont know which types. Ad Learn when the game is live learn valuable financial lessons like tackling student debt.

Navient launches new student loan calculator to help borrowers plan for faster loan repayment Mar 9 2016 WILMINGTON Del March 09 2016 GLOBE NEWSWIRE -- Calculating. Compare Ac Capacitor Now. Generally your monthly payments under Income-Based Repayment IBR Pay As You Earn PAYE and Revised Pay As You Earn REPAYE are calculated as 10 or 15 of your.

Switching to IBR would lower your current monthly student loan payment to 183 which is 213 lower than your current payment. Along with the specific ceiling of 23000 for subsidized Stafford. By taking advantage of Income-Based Repayment IBR Pay As You Earn PAYE or Income-Contingent Repayment ICR borrowers can benefit from meaningful reduction in their monthly.

Find the percentage of the debt you owe. Evaluate your repayment options for your private student loans including standard repayment extended term. Amazing Online Savings Today.

Use the calculator below to evaluate the student loan payoff options as well as the interest to be saved. Department of Education Federal Student Aid Repayment Estimator enables you to model payments under the various income-driven repayment options available. A good student loan repayment calculator takes into account the difference between subsidized and unsubsidized loans.

The lowest advertised variable APR is only available for loan terms of 5 years and is reserved for applicants with FICO scores of at least 810. FFELP loan borrowers can only benefit from. 30000 divided by 80000 is.

All Stafford and Direct Consolidated Loans made under either the Direct Loan or Federal Family Education Loan FFEL Program which. Your 30000 plus your spouses 50000 is 80000. If you choose the IBR plan your monthly student loan payment would be 149 which is 406 lower than your current monthly payment.

Department of Education ED has announced that it will make adjustments to Income-Driven Repayment IDR plan payment counters. Income-Based Repayment Plan Eligibility. With an annual income.

Income Based Repayment Ibr Calculator Lendedu

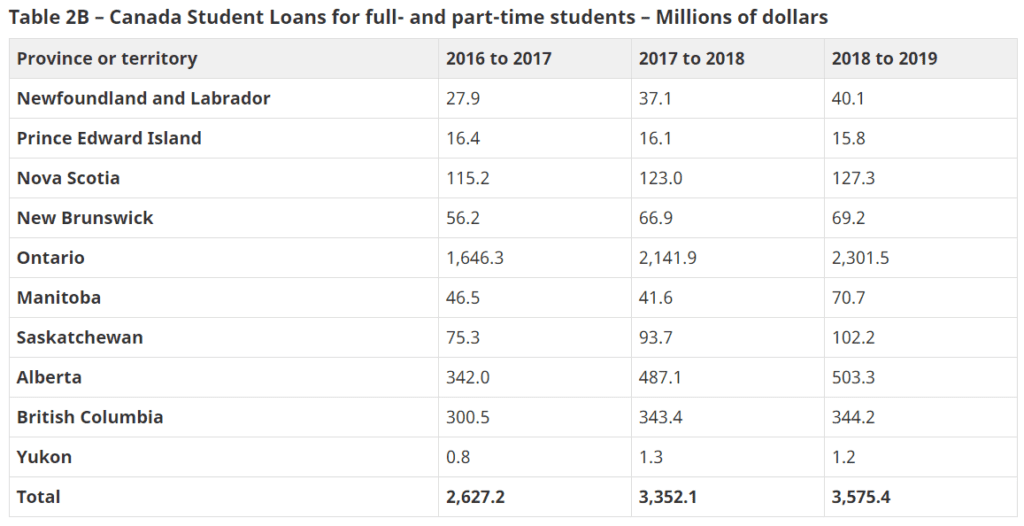

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Income Based Repayment Of Student Loans Plan Eligibility

Pin On Information

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What The Navient Lawsuit Means For Your Student Loans Part 3 Student Loan Repayment Student Loans Student Loan Forgiveness

:max_bytes(150000):strip_icc()/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)

Private Vs Federal College Loans What S The Difference

Pin On Money

Income Driven Repayment Who Needs Student Loan Payment Relief

How To Lower Student Loan Payments Credible

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero

107 Ways To Pay Off Your Student Loans Student Loan Planner

Which Is The Best Income Driven Repayment Plan For Your Student Loans Student Loan Hero

Pros And Cons Of Income Driven Repayment Plans For Student Loans

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero

Komentar

Posting Komentar