City paycheck calculator

Make Your Payroll Effortless and Focus on What really Matters. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

Paycheck Calculator Us Apps On Google Play

Although this is sometimes conflated as a personal income tax rate.

. The PaycheckCity salary calculator will do the calculating for you. Calculating your paychecks is tough to do without a paycheck calculator because your employer withholds multiple taxes from your pay. This Alabama hourly paycheck calculator is perfect for those who are paid on an hourly basis.

This number is the gross pay per pay period. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Our paycheck calculator will help you determine how much more you should withhold. This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Switch to Missouri hourly calculator. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Switch to Massachusetts salary calculator.

Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Switch to Michigan salary calculator. Switch to Louisiana salary calculator.

How Your New Jersey Paycheck Works. Exempt means the employee does not receive overtime pay. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Simply decide how much you want withheld - for example 20 per paycheck - and write that amount down on a new W-4. Switch to Arizona hourly calculator. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

This Louisiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. Ad Compare Prices Find the Best Rates for Payroll Services. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Switch to Kansas salary calculator. Switch to Iowa hourly calculator.

This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis. The PaycheckCity salary calculator will do the calculating for you. Cities and counties do not impose this tax but some do affecting approximately 10.

PaycheckCity Free payroll trial Private label calculators Products by Symmetry Our story Help center. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator.

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. Calculate your Arizona net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arizona paycheck calculator. Choose Your Paycheck Tools from the Premier Resource for Businesses.

This Kansas hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. You can also save for retirement while reducing your taxable income by putting more money into pre-tax retirement accounts like a 401k or 403b.

Federal income taxes are also withheld from each of your paychecks. This number is the gross pay per pay period. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Then enter the employees gross salary amount. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Dont want to calculate this by hand.

Switch to Alabama salary calculator. Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken out. Dont want to calculate this by hand.

It can also be used to help fill steps 3 and 4 of a W-4 form. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri paycheck calculator. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals small businesses and payroll professionals every year.

Switch to Texas hourly calculator.

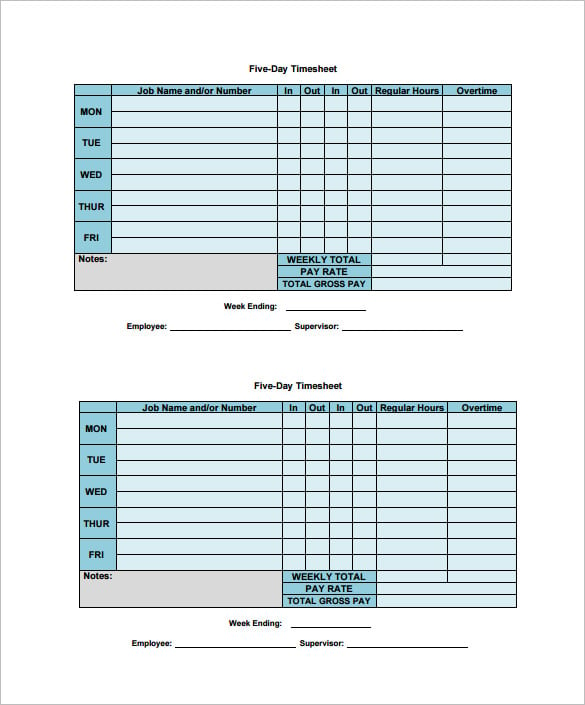

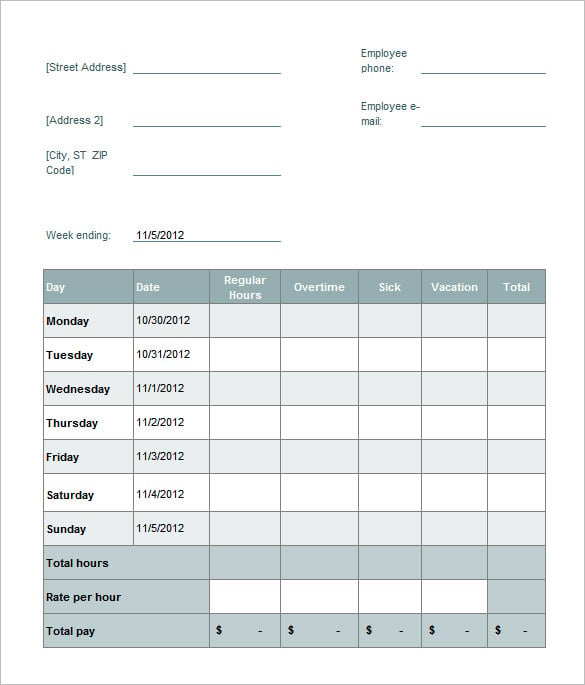

Payroll Calculator Free Employee Payroll Template For Excel

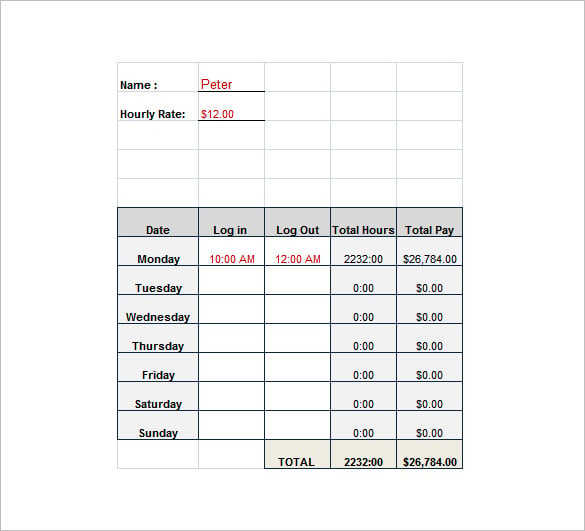

Hourly Paycheck Calculator Hot Sale 51 Off Www Wtashows Com

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

New York Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Equivalent Salary Calculator By City Neil Kakkar

Take Home Salary Calculator Store 50 Off Www Wtashows Com

Free Paycheck Calculator Hourly Salary Usa Dremployee

1wxmydejhzto9m

Calculator For Paycheck Deals 54 Off Www Wtashows Com

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Tax Calculator For Paycheck Store 52 Off Www Wtashows Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Take Home Pay Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Komentar

Posting Komentar